I find a lot of times when I write I am not only speaking to you the reader but also to myself – usually it is mostly to myself. A few months ago I wrote an article about finding satisfaction in your current situation. Boy, that message really resonates during the holiday season on so many levels.

I have been thinking a lot about finding satisfaction within your means both through the lens of personal finance but also as an individual. Being waist deep in the h oliday hustle, I think it is important to think about your current satisfaction within your family’s situation. Are you happy with your resources? Are you happy with your giving over the last year? What would you change next year?

oliday hustle, I think it is important to think about your current satisfaction within your family’s situation. Are you happy with your resources? Are you happy with your giving over the last year? What would you change next year?

Like most finance professionals, one of my professional hero's is Warren Buffet. He lives here in Omaha, not far from the University of Nebraska. He is one of those guys that, when you grow up here, does not seem like he is that big of a deal. For the record, he is a big deal.

So just like I do with any hero, I watch his interviews on TV, I follow his company and their holdings and of course I read his biographies. In particular I read “The Snowball: Warren Buffet and the Business of Life”. The book was a volume in itself, outlining each of his major business deals as well as his personal family information. Like any human, Buffet has some particular quirks that make him unique as an individual. You know, weird food preferences like cheese sandwiches and interesting past times like model trains. But one quirk jumped out that really made me think. The book discusses Warren Buffet and his attitude toward giving away money. According to this biography, giving away cash makes Buffet physically ill – yes, to give even $1 makes Buffet’s stomach turn.

Now, I don’t generally like it when people speak poorly about my hero’s, it kind of makes me feel like someone is kicking my dog.

But I have to say it… he seems like a Scrooge.

Don’t get me wrong, I understand that Buffet has become the second richest person on earth by being cast iron, but becoming physically ill when you give money away? Come On!

So here is where the satisfaction piece comes into play. Don’t you say to yourself “If I had that much money I would give it to such ’n such” – I know I do. Well, Warren has that much money and he still doesn’t want to give it to “such ‘n such”.

There comes a point in life and in money where you have to say, “ok, it is time to starting living like I am satisfied”. I would argue that for every single one of you, including me, that day is today.

True Story:

I recently had an interaction with one of the most gracious people I have ever met. I started the conversation by complimenting him on some new construction he had recently finished. Rather than simply accepting the compliment and moving on, this man turned the conversation around and complimented me for mentioning it! I could not believe it, he was actually complimenting me for complimenting him – and now I felt really good about my compliment!

I walked away from that conversation saying, DANG! I want to be just like that guy! At some point in his life he made a choice to be so satisfied with his situation that the satisfaction oozes from his body.

I’m going to make the prediction right now: You will never have enough __________________ (enter whatever it is you would like more of) until you find satisfaction with your current situation. This holiday season I am going to choose to be satisfied, I challenge you to try it too.

Contact us at: 402-938-6800

Contact us at: 402-938-6800

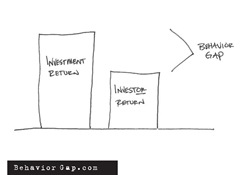

s: The standard assumed average annual inflation rate is 3%, so if I were to go out and buy a box of pencils for $1.00 today, in one year that same box of pencils will cost $1.03. As you can see, the purchasing power of my dollar has been reduced! I can no longer go out and buy a box of pencils for just a buck.

s: The standard assumed average annual inflation rate is 3%, so if I were to go out and buy a box of pencils for $1.00 today, in one year that same box of pencils will cost $1.03. As you can see, the purchasing power of my dollar has been reduced! I can no longer go out and buy a box of pencils for just a buck.